Choosing Translation Providers for Banking and Fintech

- Muhammad Faisal

- 2 days ago

- 7 min read

Updated: 8 hours ago

Every fintech firm faces the challenge of maintaining flawless multilingual communication in an evolving regulatory environment. Precise translation of compliance documents and financial reports is crucial, as a single error can spark costly audits or legal action. This overview spotlights the risks, requirements, and technology advancements shaping secure and accurate financial translation, guiding compliance officers toward providers who protect data and facilitate international growth.

Table of Contents

Key Takeaways

Point | Details |

Specialized Translation Needs | Banking and fintech require precise multilingual communication, focusing on regulatory compliance and accurate translation of complex documents. |

Importance of Technology | Advanced translation technologies enhance accuracy and efficiency, ensuring effective communication in financial contexts. |

Compliance is Crucial | Translation providers must adhere to strict regulatory standards, including data protection and compliance certifications. |

Risks of Poor Translation | Inadequate translation services can lead to regulatory penalties, financial errors, and reputational damage, making provider selection critical. |

Translation Needs in Banking and Fintech

Banking and fintech sectors demand specialized translation services that go beyond standard language conversion. These industries require precise multilingual communication to navigate complex global regulatory landscapes and effectively serve international markets.

Financial institutions face unique translation challenges involving technical documentation, regulatory compliance, and sensitive financial content. Digital transformation in banking necessitates accurate translation of critical documents including:

Quarterly and annual financial reports

Investment contracts

Compliance documentation

User interface and customer-facing materials

Regulatory submission documents

Risk assessment reports

Product descriptions and marketing materials

The complexity stems from multiple critical requirements. Financial translations must maintain absolute precision, preserve legal nuances, and adhere to local regulatory frameworks while communicating intricate financial concepts across language barriers. Terminology consistency becomes paramount, as a single mistranslated term could potentially cause significant legal or financial misunderstandings.

Pro Tip: Always request subject matter expert translators with specific banking and fintech background to ensure maximum accuracy and regulatory compliance.

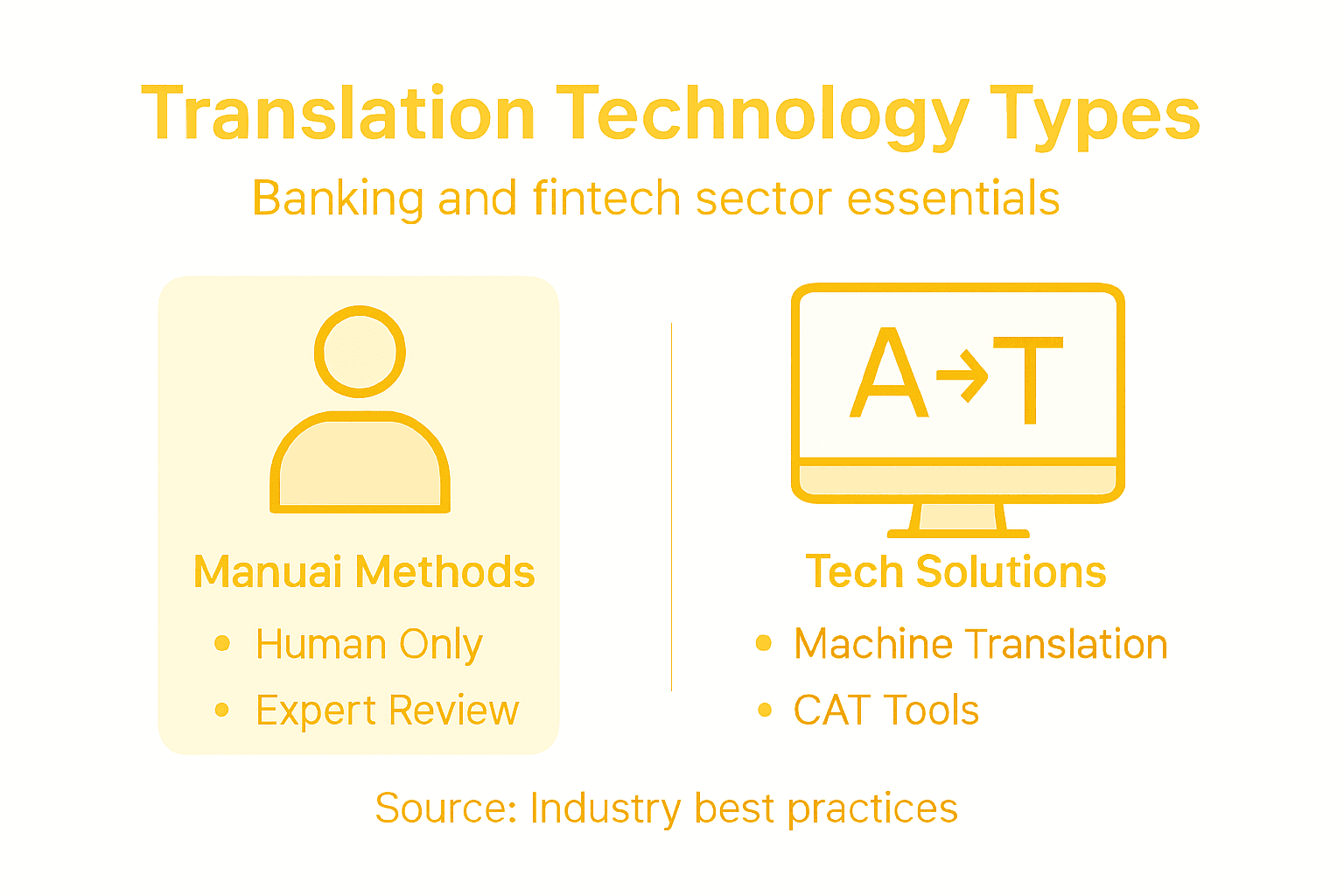

Types of Translation Technology Explained

Translation technology has rapidly evolved to meet the complex needs of banking and fintech sectors, offering sophisticated tools that enhance linguistic accuracy and operational efficiency. Computer-aided translation tools represent a critical technological advancement in managing multilingual communication strategies.

Five primary translation technologies dominate the financial translation landscape:

Machine Translation (MT) and Neural Machine Translation (NMT): Automated algorithmic translation that provides quick, initial text conversion

AI Translation (LLM-powered): Advanced AI-powered systems offering context-aware translations

Computer-Assisted Translation (CAT): Software supporting human translators with translation memories and glossaries

Real-Time Translation Tools: Platforms enabling instant cross-language communication

Translation Management Systems (TMS): Comprehensive platforms streamlining entire translation workflows

Each technology serves distinct purposes within financial communication. Machine translation offers rapid initial translations, while computer-assisted tools ensure terminological consistency and accuracy. AI translation (LLM-powered) represents the most sophisticated approach, leveraging artificial intelligence to understand contextual nuances that traditional translation methods might miss.

Here’s how various translation technologies enhance financial communication:

Technology Type | Key Advantage | Common Use Case |

Machine Translation / Neural Machine Translation | Rapid initial draft creation | Bulk document translations |

AI Translation (LLM-powered) | Context-sensitive output | Contracts with legal nuances |

Computer-Assisted Tools | Terminology consistency | Annual report translation |

Real-Time Translation | Live cross-language discussion | Customer support interactions |

Translation Management | Centralized workflow oversight | Large-scale multilingual projects |

Pro Tip: Evaluate translation technologies based on your specific compliance requirements, prioritizing solutions that offer robust security, terminology control, and regulatory alignment.

Ensuring Regulatory and Data Compliance

Translation providers in banking and fintech must navigate a complex landscape of regulatory requirements that demand rigorous data protection and linguistic precision. Compliant translations for regulated sectors require a multifaceted approach addressing security, accuracy, and legal frameworks.

Key compliance considerations for translation providers include:

Data Sovereignty: Ensuring translation processing occurs within approved geographic jurisdictions

Information Security: Implementing robust encryption and access control mechanisms

Confidentiality: Maintaining strict protocols for handling sensitive financial documentation

Regulatory Alignment: Adhering to specific industry standards like GDPR, CCPA, and sector-specific guidelines

Audit Trail: Creating comprehensive documentation of translation processes and modifications

Successful compliance requires a holistic strategy that integrates technological safeguards with human expertise. This means selecting translation providers with demonstrable experience in financial sector regulations, proven information security certifications, and a transparent approach to data handling. Advanced translation technologies must be coupled with rigorous human oversight to mitigate potential risks associated with automated translation systems.

Pro Tip: Request detailed compliance documentation and ISO certifications from potential translation providers to validate their regulatory adherence and data protection capabilities.

Evaluating Quality, Speed, and Expertise

Choosing the right translation provider requires a comprehensive assessment of multiple critical factors that extend beyond simple linguistic conversion. Global translation quality standards now provide structured frameworks for evaluating translation performance across quality, speed, and expertise dimensions.

Key evaluation criteria for banking and fintech translation providers include:

Subject Matter Expertise: Deep understanding of financial terminology and regulatory frameworks

Linguistic Accuracy: Precise translation maintaining original document’s technical nuances

Technology Infrastructure: Advanced translation management systems and AI-enhanced capabilities

Quality Assurance Processes: Rigorous multi-stage review and error validation protocols

Turnaround Time: Ability to deliver high-quality translations within critical business timelines

Compliance Certifications: Verifiable credentials demonstrating regulatory and security standards

Successful translation provider selection demands a holistic evaluation approach that balances technological capabilities with human expertise. Financial institutions must prioritize providers who combine advanced AI Translation technologies with specialized subject matter experts, ensuring both rapid delivery and uncompromised accuracy. The most effective providers integrate sophisticated AI tools with human oversight, creating a hybrid model that maximizes translation quality and efficiency.

Pro Tip: Request sample translations and conduct thorough technical evaluations before committing to a long-term translation partnership.

Risks of Inadequate Translation Providers

Financial institutions face substantial risks when partnering with translation providers lacking specialized expertise and robust quality controls. Financial translation errors can trigger devastating consequences ranging from regulatory penalties to complete market entry failures.

Potential risks of inadequate translation services include:

Regulatory Non-Compliance: Mistranslated documents triggering audits and potential legal actions

Financial Misinterpretation: Critical errors in financial reporting and contractual language

Reputational Damage: Loss of investor and customer trust due to communication failures

Market Entry Barriers: Delayed or blocked international expansions

Operational Disruptions: Misunderstandings leading to strategic miscalculations

Legal Liability: Potential litigation from inaccurate translations of critical documents

The financial implications of poor translation extend far beyond immediate linguistic errors. Unprofessional translation services can undermine an organization’s credibility, creating complex challenges that may take years to resolve. Banks and fintech companies must recognize that translation is not merely a linguistic exercise but a critical risk management strategy requiring deep domain expertise, technological sophistication, and rigorous quality assurance protocols.

The table below highlights major risks associated with inadequate translation providers and their business impacts:

Risk Area | Potential Business Impact | Long-Term Consequence |

Regulatory Errors | Costly audits or legal fines | Restricted market access |

Financial Errors | Incorrect reporting or contractual disputes | Lost revenue or investments |

Reputation Loss | Eroded trust among stakeholders | Decline in market valuation |

Operational Issues | Delayed or failed initiatives | Loss of competitive edge |

Pro Tip: Conduct comprehensive due diligence, including translation sample assessments and compliance verification, before selecting a translation provider.

Secure Precision Translation for Banking and Fintech Challenges

Choosing the right translation provider in banking and fintech means addressing critical needs like regulatory compliance, impeccable terminology control, and data security. The risks of errors in financial translations are high and can lead to costly audits, reputational damage, or legal liabilities. This article highlights the importance of combining advanced translation technologies with deep subject matter expertise to meet these demands.

At AD VERBUM we specialize in delivering precision through our AI+HUMAN hybrid translation workflow. Our proprietary AI ecosystem operates exclusively on EU servers ensuring strict data sovereignty and security standards like ISO 27001 and GDPR compliance. Supported by a global network of over 3,500 expert linguists in finance and legal fields, we ensure your documents undergo rigorous SME refinement and ISO-aligned quality assurance to preserve technical accuracy and regulatory alignment.

If your organization demands reliable terminology governance and sensitive data protection along with faster turnaround times up to five times quicker than traditional methods, explore how AD VERBUM’s specialized AI translation solutions can address your challenges. Discover more about our comprehensive quality frameworks and operational safeguards on our company overview page.

Ready to protect your financial communications from costly errors and regulatory risks Connect with us today for a tailored consultation at AD VERBUM contact and ensure your next translation project meets the highest standards of accuracy and compliance.

Frequently Asked Questions

What should I consider when choosing a translation provider for banking and fintech?

When selecting a translation provider, consider their subject matter expertise, linguistic accuracy, technology infrastructure, quality assurance processes, turnaround time, and compliance certifications. A provider with a deep understanding of financial terminology and regulatory frameworks will be crucial for accurate translations.

How can translation technology improve communication in the banking and fintech sectors?

Translation technology, such as machine translation, AI translation, and computer-assisted translation tools, enhances communication by ensuring linguistic accuracy, consistency in terminology, and improved efficiency in the translation workflow. These tools can help manage the complexities of multilingual financial documentation.

What are the risks of using inadequate translation providers in financial sectors?

Using inadequate translation providers can lead to regulatory non-compliance, financial misinterpretation, reputational damage, operational disruptions, and legal liability. These risks may result in costly audits, incorrect reporting, and strategic miscalculations, ultimately affecting the institution’s credibility and market position.

Why is compliance important in financial translation?

Compliance is crucial in financial translation because it ensures that translated documents adhere to strict regulatory standards, protecting sensitive data and maintaining accuracy. Non-compliance can lead to legal repercussions, costly audits, and damage to an organization’s reputation, making it essential to partner with providers experienced in regulatory frameworks.

Recommended